Investors are actively searching for yield while focusing on both interest rate risk management and credit risk management. With rates so low (sub-zero in many parts of the world), what is the outlook on interest rates from here? How do investors position their portfolios accordingly? At Bramshill Investments, an asset manager offering absolute return solutions in fixed income and income producing assets, we shared our perspectives in a recent market commentary. As part of our market insights, we included macro analysis on the potential impacts of rising interest rates.

We believe the two major drags on corporate earnings from 2015, a rallying US dollar and declining oil prices, have abated and will lead to stronger earnings in the second half of 2016. As a result, we anticipate a gradual rise in interest rates that could cause price deterioration for investors in long duration investment grade, municipal bonds, and treasuries. Currently 10yr inflation break-evens in the TIPS market are approximately 1.7%. This means that an investment in a 1.5%, 10yr treasury, a 2% municipal, or a taxable 3% corporate bond is most likely locking in a loss or a minor gain vs a projected low inflation rate.

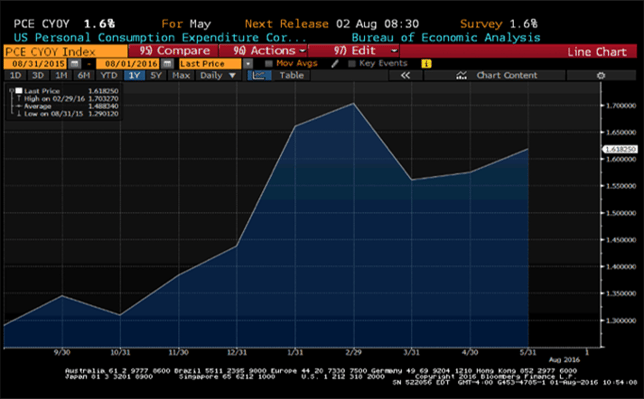

If reported earnings improve and the economic landscape stabilizes, interest rates could normalize and losses could accelerate. This especially could be the case if the Fed is behind the curve on inflation (See PCE chart below). Also evident is a moderate pick-up in inflation given recent observations in wages (See Atlanta Fed Wage Growth chart). To us, a minimum of 1/4 point increase in the Federal Funds rate in 2016 is warranted given the above mentioned inflation reference points and a current 4.9% unemployment rate which is well through the Fed’s original unemployment target of 6.5%.

![]()

Source: Bloomberg

Art DeGaetano is the CIO and Founder of Bramshill Investments, an asset management firm specializing in absolute return solutions within fixed income and income producing assets. Click here to view his bio and other team members of Bramshill Investments.

Art DeGaetano is the CIO and Founder of Bramshill Investments, an asset management firm specializing in absolute return solutions within fixed income and income producing assets. Click here to view his bio and other team members of Bramshill Investments.