Something beyond the grudging yield on Warren Buffett’s Treasury bills ought to compensate the patient investor for the tedious work of waiting for interest rates to normalize. Following is a small, curated collection of relatively high-yielding, short-duration corporate bonds. They are, for the most part, junk, though the kind of junk enhanced by the better-than-average asset coverage and cash-generation powers of their respective obligors. The collection features cushion bonds, the (relatively) high-coupon securities, which, subject to near-term call, trade close to the call price. If they’re not snatched away, so much the better for their yield to maturity or their yield to a subsequent call (Grant’s, Nov. 17, 2017).

As to yield, some perspective: The iShares iBoxx $ High Yield Corporate Bond ETF (HYG on the Big Board) delivers 6.1% with an average duration of four years, which represents 334 basis points over and above the amount quoted on the 4-year Treasury. The premium does not come for free. You, the investor, earn it for tossing and turning at night in the knowledge that more than half of the market value of HYG is allocated to bonds rated single-B or worse. By comparison, the Bloomberg Barclays Intermediate Corp. Index (BBICI) represents investment-grade, fixed-rate corporate bonds with an average rating of single-A-minus. It has an average 3.42% yield to maturity with 4.5 years of duration. Credit spread to the Treasury is 81 basis points.

What price safety? The investment-grade index, examined beside the speculative-

grade one, offers a lower average coupon (3.4% vs. 6.15%) and a longer duration. Choosing the Bloomberg Barclays alternative, an investor would be taking more interest-rate risk for not a lot of incremental compensation in credit quality. “Our objective,” declares Fabiano Santin, curator of the Grant’s collection, “is to shorten the duration compared to both indices and to get some yield in between without sacrificing credit quality.”

Santin quotes Michael Hirschfield, portfolio manager at the Hackensack, N.J., fixed-income adviser Bramshill Investments LLC, on the unpromising state of play in corporate debt: “The pickings are slim among fixed-rate corporates, and the asset class can be a minefield for investors in a rising-rate environment like today. We like keeping our duration tight by utilizing short-

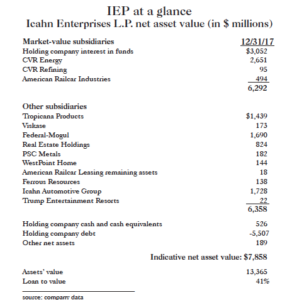

Loan to value 41% call, fix-to-floating rate exposure, as well as short-dated bonds like the Icahn Enterprises, L.P.’s 6s of 2020.”

Icahn Enterprises, L.P. is a holding company with stakes in energy, hedge funds, automotive parts, gambling (different than hedge funds), metals and mining, food packaging, real estate and home fashion. Organized as a partnership, IEP is controlled by its eponym, Carl Icahn. “Across all of our businesses,” quoth “The Icahn Strategy,” which is splashed across page one of the 2017 10-K report, “our success is based on a simple formula: we seek to find undervalued companies in the Graham & Dodd tradition, a methodology for valuing stocks that primarily looks for deeply depressed prices. However, while the typical Graham & Dodd value investor purchases undervalued securities and waits for results, we often become actively involved in the companies we target.”

All well and good for the equity investor, but hear Graham’s (not Icahn’s) comment on senior securities: “Bond selection is primarily a negative art. It is a process of exclusion and rejection rather than of search and acceptance.” The fixed-income risk-reward proposition remains the same 84 years after publication of the first edition of Graham & Dodd’s Security Analysis: Par at maturity and interest along the way constitutes the upside, total loss the downside. With no possibility of the equity home run, safety is paramount. We write for investors who need income almost as much as they need a good night’s sleep.

In financial profile, IEP consists of $31.8 billion in assets, $20.4 billion in liabilities and $11.4 billion in equity, of which $5.1 billion is attributed to IEP units (the remaining $6.3 billion being a product of the consolidation of non-

controlling interests in subsidiaries and investment funds). There is $10.3 billion of stock-market capitalization. Better if the inquisitive investor steers clear of the consolidated results; the partnership is a dog’s breakfast of businesses. The table highlights the assets that support the holding-company debt, which sums to $5.5 billion. For instance, IEP owns 82% of CVR Energy, Inc., a still public stock (CVI on the Big Board) with $2.6 billion in market cap—hence $2.1 billion belongs to IEP. CVR is an energy holding company engaged in oil refining and nitrogen-fertilizer manufacturing through the general and limited partnership stakes in CVR Refining, L.P. and CVR Partners, L.P. At the depths of the oil market in 2016, the lowest value that the market assigned to CVI shares was a cool $1 billion.

“Miscellaneous” might as well be the IEP corporate slogan. Additional operating subsidiaries include Federal-Mogul LLC and Icahn Automotive Group LLC, each 100%-owned by IEP; Tropicana Entertainment, Inc., 83.9%-owned, and the not-currently-operating Trump Entertainment Resorts, Inc., which Icahn acquired in bankruptcy (IEP owned the secured debt that converted into common stock); commercial rental properties, property development and other investment real estate; a 62% stake in American Railcar Industries, Inc. (ARII on the NASDAQ); and a not-so-immaterial “other,” which heterogenous assets could fetch $826 million based on IEP’s year-end estimates.

The most significant moving part in IEP is the $7.4 billion hedge-fund division. In the past three years, that unit has moved to the downside. Energy longs were responsible for an 18% drawdown in 2015, and “broad market hedges” for a 20% loss in 2016. The funds returned to the black in 2017 with a 2.1% gain against a 21.8% spurt for the S&P 500. Icahn, the storied money-maker, is a man of many opinions—the IEP funds finished the third quarter last year 77% net short, then got long in anticipation of the tax-bill rally, which duly came to pass. The S&P 500 index, holding no opinions, just goes where it goes. In 2016, Standard & Poor’s cited the risk of asset impairment (hedge-fund-related and other) in cutting IEP’s debt rating to double-B-plus from triple-B-minus. Over the past three years, to offset the decline in assets under management, Icahn and his affiliates have infused $1.4 billion into the funds (Icahn et al., along with IEP, are the sole investors; the funds are closed to the public); they subscribed $612 million in a 2017 IEP rights offering.

Santin asked Hirschfield about the possibility of further hedge-fund-induced losses. He replied that he shared the concern but that “the 2020 maturity will act like a par magnet and limit the price action.” The 2020 maturity is desirable for another reason, Hirschfield said: “With a [company] steered by one of the great financial minds of our time, there is always risk of him playing games with his capital structure—specifically, massively favoring his equity to the rest of his capital stack. This is why we’ve elected to own only his first maturity.”

The senior unsecured 6s of 2020, of which $1.7 billion are outstanding, constitute that maturity, and there is $3.8 billion in other holding-company debt maturing from 2022 onwards. Another $5.7 billion in debt, owed by various subsidiaries and consolidated on the balance sheet, does not represent holding-company obligations. For liquidity purposes, IEP holds $526 million in cash plus the aforementioned $3 billion hedge-fund investments, which are subject to redemption upon notice (Icahn and affiliates contributed the rest of the $7.4 billion). On Dec. 31, 2017, if you marked IEP’s assets to market and estimated non-quoted values to calculate a corporate loan-to-value ratio, that figure would have come in at 41%, based on company estimates. The 6s of 2020 change hands at 102 for a 5.1% yield to maturity. If called at par in August 2019, they would deliver a yield-to-worst of 4.5%.

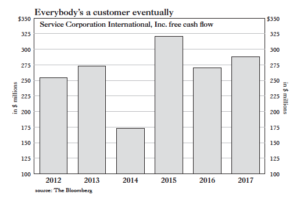

“Worst,” in the context of the everyday business of Service Corp. International, obligor of the double-B-rated 53/8% senior unsecured notes due 2022, has an existential meaning. Service Corp., with 1,488 locations and 473 cemeteries in 45 states, eight Canadian provinces, Washington D.C., and Puerto Rico, is the largest provider of funeral and cremation services in North America. Santin, perhaps thinking of the veterans of the 1946–81 bond bear market, observes that the baby-boom generation will provide a demographic tailwind both to Service Corp.’s funeral business (60% of 2017 revenue) and cemetery segment (the remaining 40%).

“The rise in cremation and attendant fall in vault and casket profits that may worry buy-and-hold equity investors shouldn’t be a concern for creditors of the 53/8s,” Santin observes. “Service Corp. owns Neptune Society, Inc. (now called SCI Direct), the country’s No. 1 conductor of cremations. Nearly 45% of SCI’s revenues come from deferred sales with funds held in trusts while the customer is alive and released to SCI upon death and delivery of casket and a decent burial. It’s also set to earn higher yields in trust funds with the rise in interest rates.”

Service Corp.’s vital signs, 2017 vs. 2016, are as follows: Revenues of $3,095 million vs. $3,031 million; operating income of $569 million vs. $511 million; free cash flow (cash from operations less capital expenditure) of $288 million vs. $270 million. At Dec. 31, 2017, debt to EBITDA was 4 times, interest coverage from operating income to interest expense, 3.4 times. The Service Corp. 53/8s, of which $425 million are outstanding, trade at 1021/8 to yield 3% to the July 2018 call price of 101.344. Yield to maturity is 4.8%, or 225 basis points over the Treasury.

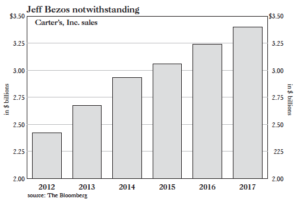

On now to Carter’s, Inc., the long-established children’s clothing vendor, at the other end of the life-cycle spectrum. The Carter’s 5.% senior unsecured, double-B-plus-rated notes due 2021, of which $400 million are outstanding, trade at 102. for a 4.5% yield to maturity, to a 3.1% yield at the August call of 101.313. Carter’s and OshKosh, founded in 1865 and 1895, respectively, are the brands that stock 830 company stores in the United States, 179 in Canada, 41 in Mexico and more than 17,000 non-company American locations (department stores, national chain stores, specialty stores and discount retailers). “Although,” comments Santin, “Jeff Bezos glowers at Carter’s, as he does at just about everyone, holders of the 5.s should be comfortable with the margin of safety shown by overall results and credit metrics. Thus, comparing 2017 to 2016, net sales rose to $3.4 billion from $3.2 billion and adjusted EBITDA ascended to $530 million from $499 million. Free cash flow dipped to $260 million from $280 million, owing to the timing of payments. Debt to EBITDA stands at 1.1 times and interest coverage at 14 times. Even after considering about $1 billion in operating leases as debt, leverage comes in at 2.3 times adjusted earnings before interest, taxes, depreciation, amortization and rent (EBITDAR), and EBITDAR coverage of interest and rent at 3.6 times. Why, then, a junk rating? The agencies cite the risks associated with the children’s clothing industry (‘highly competitive and fragmented,’ according to S&P’s May 16, 2017 report) and ‘limited international sales.’ ”

Our final single-name candidate is Spirit AeroSystems Holdings, Inc. and its triple-B-minus-rated, 5.% senior unsecured notes due 2022, of which (alas) but $300 million are outstanding. While not quite a museum piece, a callable, cheap, investment-grade cushion bond is a rarity, observes David Sherman, founder and portfolio manager of Cohanzick Management LLC.

Spirit designs and manufactures aircraft parts for The Boeing Co. and Airbus S.A. (81% and 15% of sales, respectively): fuselages, propulsion and wing systems, both for military and civilian application. Long-term supply contracts are the revenue lifeblood; unfilled orders stood at $47 billion at the end of last year, higher than the $43 billion five-

year average for the period ended Dec. 31, 2016. Repricing of some Boeing contracts caused a drop in 2017 free cash flow to $300 million, from $463 million in 2016. It appears to be a blip, as Spirit is pointing to 2018 free cash flow in the neighborhood of $550–$600 million, up from a previously projected $450–$500 million. Year-end credit metrics shone, with debt to EBITDA at 1.5 and EBITDA to interest expense by no less than 15. The Spirit 5.s trade at 102. cents on the dollar for a 4.5% yield to maturity. If called in April at 102.63 cents, the yield drops to 3.7%.

It was at Sherman’s suggestion that we highlighted the McGraw-Hill Education’s 8.5s of 2019 last autumn (see the Nov. 17, 2017 issue). Formerly quoted at a premium, they are now offered at 99. for a yield of 8.7% to the August 2019 maturity. The company tendered for $256 million of the 8.5s in December, but $244 million remain outstanding. No other debt maturities come due before 2022, and $350 million is available under a revolver.

“As for the other cushion bonds discussed in these pages last year,” writes Santin, “let’s start with Dell Technologies, Inc’s 71/8s of 2024. They are down by one point since we wrote about them. At that, they have performed as they were supposed to since a bondholder has earned two points in accrued interest in the meantime. The securities are still attractive, we think, yielding 5% to the June 15, 2019 call, although the rise in rates has tightened the credit spread to Treasurys to 250 basis points from 286 basis points in November. The Dollar Tree, Inc.’s 5.s of 2023 are down by a quarter of a point, though holders have clipped more than 1. points during the period. Fortescue Metals Group, Ltd. is calling the full amount of its outstanding 9.s of 2022 in April at 109., which means that bondholders will net about 4.5% in yield to call, more than triple the amount available in three-month bills then). If the investor had bet on the HYG or in a portfolio reflecting the BBICI, he would have lost 20 and 40 basis points, respectively.

“Those who would rather go to the dentist than call a broker to bid for junk bonds,” Santin continues, “may consider Sherman’s CrossingBridge Low Duration High Yield Fund (CBLDX) that seeks ‘high current income and capital appreciation consistent with the preservation of capital.’ The fund invests at least 80% of its net assets in high-yield fixed-income securities (bonds and loans) with less than three years of maturity and an average weighted investment horizon of three-quarters of a year to two years, limiting credit and interest-rate risk. Launched in January, the fund has accumulated assets of only $5.5 million, though the adviser and its affiliates have been running various credit-related vehicles since 1996 and manage a total of $2.1 billion. There are institutional- and investor-class shares, and the fund’s advisers have agreed to limit fees to 0.9% until at least January 2020, with certain exceptions; the investor class has a 0.25% distribution fee. Dial (888) 898-2780, or go to www.crossingbridgefunds.com.

“Another fixed-income mutual fund—for institutions only—that is ready for higher rates is the Bramshill Income Performance Fund (BRMSX), the duration of whose assets is currently 0.2 years,” Santin goes on. “No contractual mandate stipulates such a defensive posture; the managers just happen to be worried about interest rates and market values. ‘We have maintained caution due to complacency and the extended fixed-income valuations both in yield and spread in the credit markets, which likely warrant a repricing of risky assets,’ says Bramshill regarding its low-duration portfolio. The fund, which got its start in 2009, has $197 million in net assets, and the investment adviser, which has been in operation since 2012, manages over $872 million. As of Dec. 31, 2017, BRMSX held 18.8% in corporate bonds, 64.3% in preferred stocks, 14.7% in ETFs, 10.2% in closed end funds, 2.1% in munis and 14.8% in U.S. Treasurys. Call (877) 272-6718 orgo to www.bramshillfunds.com.”

*PLEASE NOTE:

Bramshill Investments, LLC has acquired one-time reprint rights for this copyrighted article.

As their recipient, PLEASE do not post this on any website, forward it to anyone else, or make copies (print or electronic).

To subscribe to Grant’s, just call 212-809-7994 or find us on the Web at www.grantspub.com.

Copyright ©2018 Grant’s Financial Publishing Inc. All rights reserved.

_________________________________

source: company data 12/31/17