The Bramshill Income Performance Strategy is a fixed income strategy that seeks to maximize total return across various asset classes. The Strategy invests in a tactical portfolio of income-producing securities, including investment grade and high-yield bonds, preferreds, municipal bonds, U.S. Treasuries. The portfolio is actively managed, incorporating sector allocations and tactical hedging during various interest rate and market environments. The Strategy uses fundamental credit and relative value analysis, and focuses on securities with transparent pricing, actively-traded capital structures and liquidity. The Strategy is unlevered, highly-liquid, not benchmark dependent and seeks to maintain an investment grade profile.

To obtain a compliant presentation and/or the firm’s list of composite descriptions, please email us at info@bramshillinvestments.com.

Bramshill Investments may be accessed through two product types: separately managed account and mutual fund (Bramshill Income Performance Fund – BRMSX).

The Bramshill Tactical Fixed Income Strategy is offered through one or more pooled investment vehicles, the interests of which are privately offered only to accredited investors and/or qualified purchasers. The strategy invests across three uncorrelated asset classes: preferreds, corporate credit and municipals. The strategy’s positioning is based on relative value and fundamental credit analysis. The Fund utilizes 1-2 turns of leverage directionally seeking to capture mispricings of undervalued and overvalued securities. The strategy utilizes proprietary and custom built quantitative and systematic alert systems built to capture intra-capital structure dislocations. The strategy invests in liquid, transparent securities with quarterly liquidity terms.

To obtain a compliant presentation and/or the firm’s list of composite descriptions, please email us at info@bramshillinvestments.com.

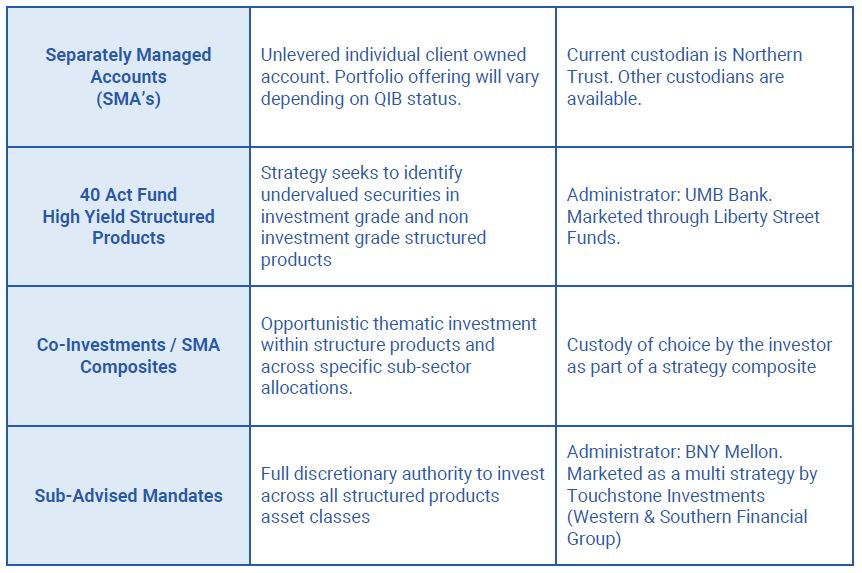

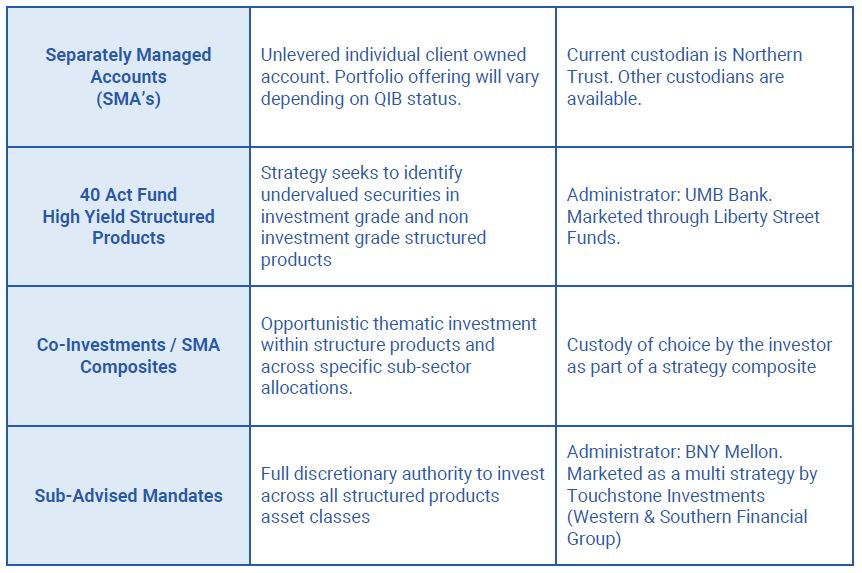

The Structured Products strategies and the experienced investment team are led by a seasoned portfolio manager, Paul van Lingen, who is a thirty-year veteran in Structured Products. The investment team’s process, focused on Paul’s investing style and risk management expertise, has proven to find opportunities by staying patient and being highly liquid to take advantage of commonly occurring market dislocations. The strategies use a top-down and bottom-up fundamental analysis supported by quantitative and qualitative models to invest in Structured Products secured by cash-flowing assets (ratings agnostic). The Structured Products market includes Agency and non-Agency RMBS and CMBS, ABS, CLO, whole loans and other instruments secured by assets that generate cashflow. The team actively rotates positioning within the Structured Products market, seeking the sectors and investments with the best relative value and risk adjusted returns, typically positioned high in the capital structure and low in duration. Portfolios are highly liquid, not benchmark dependent and utilize short duration securities and when appropriate moderate leverage. Our learned history combined with remaining areas of core competencies are key attributes to our management of structured products.

The Bramshill-SIG UCITS Income Performance Fund is an open-end fund incorporated in Ireland. The Fund's objective is to maximize total return across a diversified portfolio of fixed income products. The Fund invests in income-producing securities, including US corporate credit, US Preferreds, US Municipals and US Treasuries. The Fund may also invest up to 10% in comingled vehicles including ETF’s and Closed-End Funds. The Strategy uses fundamental credit and relative value analysis, and focuses on securities with transparent pricing, actively-traded capital structures and liquidity. The Strategy is unlevered, highly-liquid, not benchmark dependent and seeks to maintain an investment grade profile.

To obtain a compliant presentation and/or the firm’s list of composite descriptions, please email us at info@bramshillinvestments.com.

The All Weather Income Strategy, incepted in 2016, is a diversified portfolio of income-producing securities. The strategy is managed in an individual account format and seeks to maximize total return across various sectors via dividends and income. The strategy invests across liquid markets such as real estate investment trusts, master limited partnerships, business development corporations, preferred securities, royalty trusts and closed-end funds. The strategy has a flexible allocation mandate which seeks to produce a consistent income across all market cycles. The portfolio is actively managed, incorporating a proprietary distribution model which focuses on high conviction income-producing securities with compelling risk-reward characteristics. The strategy uses a top down approach for macro analysis combined with a bottoms up fundamental analysis for individual security selection. The strategy is unlevered, highly-liquid and not benchmark dependent.

To obtain a compliant presentation and/or the firm’s list of composite descriptions, please email us at info@bramshillinvestments.com.

With these client driven mandates, we are highly focused on staying within our core competencies. We can offer investors SMAs or a fund of one structure specific to an asset class within a broader strategy. Examples would be a Preferred allocation with our larger Income Performance Strategy, or a structured products mandate focused on specific collateral criteria. Asset class exposures, credit ratings, yields, and duration criteria can all be targeted. We can customize these with highly detailed reporting and data analytics from our internal Broadridge systems, integrating with a clients custodian of choice. These strategies tend to be larger mandates in nature and run parallel to many of the investment allocations across the firm.